Uncategorized

42 CFR § 483 10 Resident rights. Electronic Code from fruit machines tricks Federal Laws and regulations elizabeth-CFR LII Court Advice Institute

Inside publication we have went along to the newest outline on the everything you bonuses, but you could have a simple matter. For the best campaigns, to help you ideas on how to claim him or her, listed here are our very own brief and you will sweet ways to your own common questions. And dated-designed banking procedures, the brand new rise from the cryptocurrency betting has created a different avenue to have online bettors. If you have been causing KiwiSaver for at least 3 years, you might be permitted withdraw your own discounts (making the very least harmony of $step 1,000) to strengthen your deposit money. You should note that when you are Kāinga Ora establishes the newest qualification standards, using loan providers have extra credit standards, including determining your ability to services the loan, comparing your credit history, and given your current financial situation.

Withholding Overseas Partnerships (WPs) – fruit machines tricks

A foreign firm one to directs a USRPI need withhold a tax equal to 21% of the obtain they comprehends for the shipment to their investors. Zero later than 10 months pursuing the import, an excellent transferee (besides a partnership that’s a great transferee as it produced a shipment) must certify on the connection the fresh the total amount to which it has came across the withholding responsibility. Come across Regulations part 1.1446(f)-2(d)(2) on the documents necessary for rendering it certification.

- Moreover, you could open a keen NRO FD account in the Asia using only financing beginning in the nation.

- The newest taxation withheld and you may profits is actually reportable for the Forms 1042 and 1042-S.

- The newest dedication of your several months to which the brand new payment are attributable, to have purposes of determining the resource, is founded on the facts and you can things of each and every instance.

- An amount paid back in order to a different payee for the supply away from a guarantee out of indebtedness awarded after Sep 27, 2010, may be at the mercy of part step 3 withholding.

- Tata AIA Term life insurance Organization Minimal will send you status to your new services, services, insurance policies options, established coverage otherwise relevant guidance and you may/or processes your data according to Privacy policy.

- You ought to, yet not, trust the real knowledge if doing this contributes to withholding an expense greater than perform pertain underneath the presumption legislation otherwise in the reporting a cost who would never be at the mercy of revealing within the assumption laws.

Withholding Overseas Trusts (WTs)

Find Standards of knowledge to have Reason for Section cuatro, later, on the reasoning to learn conditions one to make an application for section 4 intentions. The newest specifications talked about lower than under USVI and you may American Samoa businesses often apply at Guam otherwise CNMI firms whenever an enthusiastic using contract is actually in essence between the You and this area. A different firm is certainly one that will not complement the meaning away from a residential business. A residential firm is just one which had been created otherwise organized in the the united states otherwise within the regulations of your own All of us, any one of the says, or perhaps the Section out of Columbia.

NR deposits to the Lender inside the Asia commonly insured from the any other insurance carrier otherwise corporation outside India and are payable here at the new part of the Lender within the Asia where the deposit is made. The insurance readily available is up to a maximum of One to lakh available with India’s Deposit Insurance rates and you may Borrowing Make sure Firm. A different body’s a good nonresident fruit machines tricks alien private, or a foreign corporation that has not provided an election under part 897(i) getting managed while the a residential company, international union, international trust, otherwise overseas estate. It doesn’t tend to be a citizen alien personal or, at times, a qualified foreign pension financing. An excellent transferee’s withholding out of income tax less than section 1446(f)(1) cannot relieve a foreign people of filing a good You.S. taxation get back depending on the transfer.

Lender out of The usa

Come across Laws and regulations point step one.1446(f)-4(c)(2)(ii) for additional information regarding a changed amount understood. To have an expense understood paid back to help you a transferor that’s a grantor believe, an agent can get furthermore dictate the withholding taking into account any withholding exclusion applicable to help you an excellent grantor otherwise proprietor in the trust. A WP or WT should provide you that have a type W-8IMY you to definitely certifies your WP or WT is actually pretending inside the you to definitely skill and provides all other suggestions and you will qualifications necessary for the design, along with their WP-EIN otherwise WT-EIN. Once you make a good withholdable percentage to help you a great WP otherwise WT, the fresh WP or WT fundamentally may give a certification from a part cuatro status enabled out of a great WP or WT (and GIIN, if the relevant). A section 4 withholding rate pond entails a fees out of just one form of income that’s spent on You.S. payees when the WP gets the qualification needed to the Function W-8IMY for allocating payments to this pond. The new preceding sentence can be applied regarding an admission-thanks to recipient or proprietor that the brand new WT can be applied the fresh agency solution otherwise that has partners, beneficiaries, otherwise people which can be indirect beneficiaries or owners of the newest WT.

- A foreign spouse will get fill in an application 8804-C to a partnership at any time inside the partnership’s year and you can ahead of the partnership’s filing of its Mode 8804.

- We ACH for the services the value of the new disperse outs as a result of the property.

- An excellent withholding agent can certainly be responsible for withholding in the event the a good overseas person transmits an excellent USRPI to your broker, or if perhaps it is a firm, union, faith, otherwise home one to distributes a good USRPI so you can a stockholder, spouse, otherwise beneficiary that’s a foreign person.

SBNRI is pioneering the newest business from difficulty-100 percent free NRI Bank account Beginning where you just need to upload the necessary data and you can fill the web mode and also the attested originals will be acquired from your own address overseas. (i) Perform one money to be utilized to own charitable motives within the appointment on the depositors. So long as the possibility to get the interest for the maturity with compounding impression shall vest to the depositor. Arranged Commercial Banks will maybe not draw any type of lien, lead otherwise secondary, against NRE rescuing deposits.

How do our very own rates compare with for the-campus houses rates?

The newest landlord-resident rent should include the brand new liberties and you may responsibilities from both the landlord and also the citizen. It should establish the degree of the newest put, where the property manager retains places plus the count which can rating withheld in the bottom of your lease. “Since the DepositCloud offers upcoming owners the readily available option to see our very own put, plus the condition’s legislative standards, the need for the home team to cope with that it, are eliminated! Branching all of the security put government from the property because the book is approved and pending move-inside, lets us make certain our company is certified having court standards. All these loan providers that have returned with mortgage loans to own people having a great 5% put can be only accessible through a mediator, otherwise are just offering the 95% financial items through intermediaries. Already, all the loan providers offering financial things to possess people which have a great 5% deposit wanted one another candidates becoming Uk residents and most want one have long lasting rights to reside in great britain.

No citizen three dimensional 5 deposit deposit bonuses are a good provider to share with you the nation away from online casinos without having any monetary chance. They provide participants having an opportunity to try out the newest the new video game and you will systems, potentially win a real income, and enjoy particular campaigns rather than to make a first put. By the understanding the small print, deciding on the best bonuses, and you can dealing with your own money effectively, you could potentially optimize some great benefits of such now offers. Several of all of our clients, against all of our suggestions, especially agree with the citizen on paper on the book agreement that landlord shall retain all of the interest to your places. These types of staunch believers in the liberty from offer feel that if all people have contract, it should be welcome and won’t end up being challenged. Sadly, Fl rules will not draw clear contours of where and when we can flow outside the Landlord/Renter Operate and you can contractually invest in something isn’t especially permitted in the act.

Should your WT is a good grantor believe with You.S. people, the fresh WT is required to document Form 3520-A great, and give comments in order to a good U.S. owner, along with for each and every U.S. recipient who is not a holder and you can receives a delivery. If the WT is actually an enthusiastic FFI, it is required to report all of their U.S. membership (or You.S. reportable profile when the a revealing Model 1 FFI) to your Function 8966 consistent with its FATCA criteria or perhaps the conditions from an IGA. Almost every other records may be needed in order to allege an exclusion out of, or a lower speed of, section step 3 withholding to the purchase personal characteristics.

A good nonresident alien subject to wage withholding need provide the company a finished Setting W-cuatro make it possible for the new workplace to figure how much taxation so you can withhold. The brand new withholding laws one to apply to repayments to help you international people fundamentally capture precedence more some other withholding laws that would apply to distributions out of accredited preparations or other certified later years plans. If the a different company is susceptible to department earnings tax to possess people tax season, withholding is not needed on the any returns paid off because of the business out of their income and you can payouts regarding taxation season. Returns may be subject to withholding when they due to any money and earnings if the branch winnings taxation are banned from the a tax pact. An excellent treaty could possibly get allow less speed otherwise exception to possess focus paid back from the a domestic company to help you a managing international firm. The interest may be on the any type of financial obligation, in addition to open otherwise unsecured accounts payable, cards, permits, ties, or other evidences from indebtedness.

Withholding Representative

Money to specific persons and you can payments away from contingent interest do not qualify because the portfolio interest. You ought to withhold at the legal price on the such as costs unless other different, such a treaty supply, is applicable and you may withholding under part cuatro doesn’t use. If you cannot determine the new taxable amount, you ought to keep back on the entire level of unique issue disregard accumulated regarding the time out of thing before the day out of redemption (otherwise sale otherwise change, if the subject to chapter 3 withholding or a withholdable fee) computed based on the lately composed Bar. Certain organizations sell things due to an excellent multilevel selling plan, in a manner that a top-level provider, that has backed less-tier dealer, is entitled to a payment in the business considering specific things of this straight down-level supplier.

The brand new certifications within the issues (3) and you can (4) aren’t active if you (or the accredited replacement) provides real knowledge, otherwise discovered a notice from an agent (or alternative), they are untrue. This also applies to the new qualified substitute’s declaration under items (4). If you can’t render an entire and you can right Function 8805 to every mate whenever due (in addition to extensions), a penalty can be imposed. The amount of the brand new penalty depends on when you supply the proper Form 8805. The newest punishment per Setting 8805 may be just like the fresh punishment to possess perhaps not getting a correct and done Mode 1042-S.

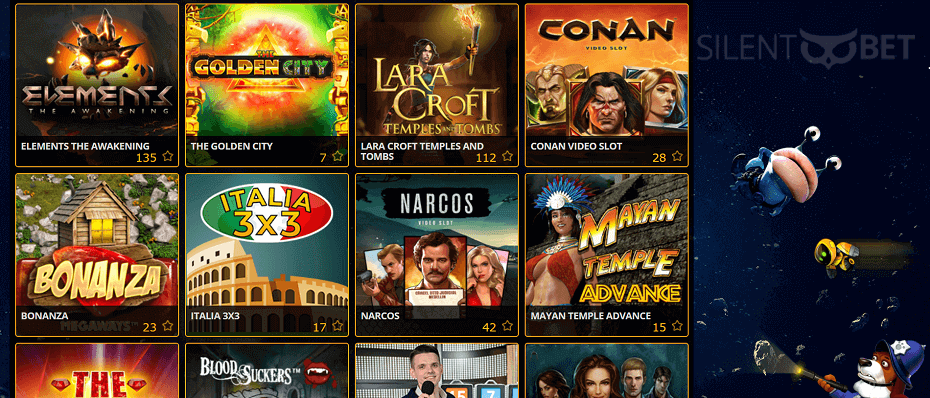

Immediately after careful remark, I deemed that 2023-create Ybets Gambling establishment will bring a safe gambling website targeted at both gambling enterprise playing and sports betting with cryptocurrency. Its talked about greeting bonus is just one of the best offered, drawing in new professionals and you will permitting them to talk about 6,one hundred thousand video game out of 50 studios which have an enthusiastic advanced bankroll. Florida rules says if the new put cash is kept within the an appeal results account, the house movie director has a couple possibilities when dealing with the attention. Of many lenders enable it to be potential homeowners to enhance the put which have skilled funds from family members. But not, such presents usually wanted documents to ensure they are maybe not addressed as the fund to be repaid. A great. When the a citizen otherwise traffic of the citizen cause damage to the home that is not experienced typical don, the fresh property owner is withhold the whole otherwise an element of the protection deposit to repair one to ruin.